We all know that bad data in = bad data out.

When contract data is unstructured, everything downstream suffers.

Manual billing and invoices, messy spreadsheets, and hours of reconciliation that never quite tie out.

Tabs fixes that.

We’re the AI-native revenue platform that automates the entire contract-to-cash cycle. Whether you're selling custom terms, usage-based pricing, or a mix of PLG and sales-led, Tabs turns month-end chaos into clean cash flow.

✅ Instantly generates invoices and revenue schedules from complex contracts

✅ Automates dunning, revenue recognition, and cash application

✅ Syncs clean, structured data across your ERP and reporting stack

Trusted by companies like Cortex, Statsig, and Cursor, Tabs powers the finance teams behind the next wave of category leaders.

Your ARR deserves better.

Most startup growth stories start with the same battle cry:

“Just get some revenue in the door.”

And fair enough… you need to validate your product survives the physics of someone actually putting down a credit card. But revenue alone isn’t a strategy. It’s a starting point.

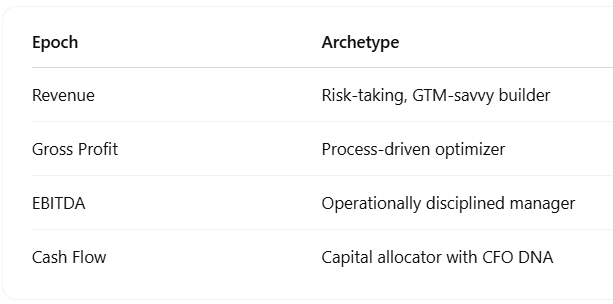

To truly build a durable business, companies evolve through distinct financial epochs. Each stage comes with a different scoreboard, priorities, and—most importantly—type of operator at the helm.

Think of it like a video game with four increasingly difficult levels:

Level 1: Drive revenue at all costs.

Level 2: Make that revenue profitable.

Level 3: Show it’s sustainable.

Level 4: Actually return some of that cash.

In this post, we’re breaking down each epoch—from the raw top-line chase to refined cash flow conversion—and the shifts the C-Suite (not just CEOs and CFOs) need to make in order to graduate.

1. The Revenue Epoch:

Proving the Market & Scaling Top-Line Growth

Key Focus: Drive as much revenue as possible, as fast as possible.

At this stage, the company is laser-focused on:

Building a product

Finding customers

Achieving product-market fit

“The first thing you have to do is drive revenue. You’ve got to build a product, find customers, and prove the business model.” — Michael Bayer, CFO of Wasabi

Real-World Example: Companies like Cursor and Codeium are proving that customers will rip AI-native products out of their hands. But what’s TBD is whether it's repeatable and renews on its own.

Sales Comp Trap: This is also where misaligned incentives can sneak in. If reps are only comped on logos and not retention, you risk flooding the business with bad-fit customers.

Biggest Risk: Scaling fast without understanding what it actually costs to serve the customer.

2. The Gross Profit Epoch:

Proving You Can Make Money Selling the Product

Key Focus: Show that the revenue you’re booking actually makes economic sense.

You’ve sold the thing. Great. Now… are you making money on it?

This is the phase where companies get serious about:

Pricing strategy (seats vs. usage vs. outcomes)

Cost of goods sold (COGS)

Gross margin improvement

This is also where usage-based models start to flex their muscles. Companies like Snowflake and OpenAI benefit from infrastructure that amortizes better as volume increases. But only if customer usage patterns scale efficiently and pricing matches value delivered.

You’re not just chasing top-line anymore. You’re pressure-testing whether every new dollar of revenue actually adds to gross profit.

Real-World Example: Uber and DoorDash once lived in this land of empty calories—subsidized rides and meals in exchange for growth. Their pivot toward increasing take rates and tightening delivery ops signaled a transition to profitability-first thinking.

Biggest Risk: Mispricing the model or failing to course-correct when COGS quietly inflates.

3. The EBITDA Epoch:

Proving You Can Operate a Sustainable Business

Key Focus: Show that the company can survive without external funding.

Here the focus shifts from margins to overall efficiency. The full P&L comes under scrutiny, especially:

Opex (especially sales and marketing)

Customer acquisition costs (CAC)

EBITDA margins and net income

This is where CFOs earn their stripes as capital allocators. But it's also where startups get distracted with shiny side quests:

Common Distractions:

Launching a podcast that doesn’t drive pipeline

Opening a Paris office with no presence in the EU

Acquiring a dev tool when you don’t sell to developers

Real-World Example: Meta (formerly Facebook) proved this out with its “Year of Efficiency.” After years of innovation sprawl, they cut aggressively and saw record profitability—rewarded handsomely by the market.

Biggest Risk: Cutting muscle instead of fat. Sacrificing long-term growth for short-term optics.

4. The Cash Flow Epoch:

Returning Capital & Sustaining Long-Term Value

Key Focus: Generate reliable free cash flow (FCF) and return value to shareholders.

This is the final boss stage. Cash generation isn’t just a KPI—it becomes the company’s identity.

At this point, the business should:

Optimize working capital

Maintain consistent FCF

Return capital via dividends, buybacks, or smart reinvestment

Real-World Example: Apple. No explanation needed. It’s a cash machine that can self-fund and return billions annually, without compromising innovation.

Biggest Risk: Playing it too safe. Hoarding cash and missing the next wave of growth.

"The most mature companies focus on cash flow. Ultimately, we’re all here to pay the rent on the capital that’s deployed in the business." -Michael Bayer

The Talent Challenge: Hiring for the Right Epoch

One of the biggest takeaways from Bayer’s framework is that different types of talent thrive in different epochs:

"Some people are just more comfortable in earlier-stage companies, and others thrive in more mature environments. The best people have a growth mindset and can adapt across these epochs." -Michael Bayer

There’s a common phrase: “what got you here, won’t get you there.” This is true across all levels of the org when growth starts to outpace talent.

Final Takeaways: The PE Operator Playbook

For PE-backed teams, understanding your current epoch isn’t just helpful—it’s an essential reality check that guides your future bets.

Ask yourself:

What phase are we really in?

Do we have the right leadership for this phase?

Are we allocating capital in line with our epoch?

Because if you’re playing the wrong game for your growth stage… you’re not just wasting time.

You’re wasting capital.

Run the Numbers

Apple | Spotify | YouTube

Serial CFO Michael Bayer, who is currently the CFO of Wasabi, joined me to share wisdom from his long career.

He talks about his journey from being a “CF-no" to becoming a “CF-go”

He breaks down the epochs of growth that a company goes through as it scales from driving revenue to focusing on cash flow.

He highlights the significance of order of magnitude thinking and hiring for future needs.

Michael also introduces his “rock-turning” exercise for identifying and addressing issues when joining a company

He shares his three guiding principles: speed is God, best ideas win, and if you’re not making mistakes, you’re not trying hard enough.

The episode concludes with an insightful story about Van Halen's "brown M&M" clause, and what finance leaders can learn from it.

Did you like today’s issue? I’m always open to feedback.

This newsletter is new and I’d love for you to forward it to your colleagues.