The Private Equity Playbook for Build vs. Buy vs. Partner

A four part test to determine the right path

We all know that bad data in = bad data out.

When contract data is unstructured, everything downstream suffers.

Manual billing and invoices, messy spreadsheets, and hours of reconciliation that never quite tie out.

Tabs fixes that.

We’re the AI-native revenue platform that automates the entire contract-to-cash cycle. Whether you're selling custom terms, usage-based pricing, or a mix of PLG and sales-led, Tabs turns month-end chaos into clean cash flow.

✅ Instantly generates invoices and revenue schedules from complex contracts

✅ Automates dunning, revenue recognition, and cash application

✅ Syncs clean, structured data across your ERP and reporting stack

Trusted by companies like Cortex, Statsig, and Cursor, Tabs powers the finance teams behind the next wave of category leaders.

Your ARR deserves better.

Every private equity-backed executive—whether a CEO, CFO, COO, or Operating Partner—faces the Build vs. Buy vs. Partner decision. It’s one of the most critical levers for driving enterprise value while staying within the risk-adjusted return expectations set by investors.

At its core, this decision is about balancing speed, control, and capital efficiency while working within the guardrails of a defined investment horizon. Arvind Kadaba, CFO at Aidoc, shared a structured approach on Run the Numbers, breaking the decision into three key factors:

"It’s the standard build, buy, partner calculation that every executive goes through. If you want to build it, how much roadmap distraction would it be? Is it already planned, or are you pulling it forward? And what’s the opportunity cost of that decision?"

1. The Roadmap Test: Will This Distract from Core Business Growth?

Every PE-backed company has a value creation plan—a roadmap of initiatives designed to maximize EBITDA growth and valuation expansion within a defined timeline. If an initiative isn’t already on the roadmap, adding it can delay revenue-generating features or force trade-offs.

If it’s in next year’s roadmap, it may be worth accelerating.

If it’s 3-5 years out, it’s likely a distraction from near-term growth objectives.

If it’s not on the roadmap at all, buy or partner instead—it’s not worth the focus shift.

“You can make a judgment call on pulling that forward and the cost of that relative to the economics you have to give away on the partner side and the valuation multiple you have to pay on the acquisition side.”

Case Study: Klarna’s Internal CRM Gamble

Klarna made headlines by ripping out Salesforce & Workday and opting to build internal versions of both systems. Their argument? Control and cost savings. The downside? Lost productivity and slower time to value.

“You don’t get extra credit points for this. The risk is slowing down the teams that generate revenue.”

Key takeaway: If building will delay growth-driving initiatives, it’s likely not worth it—especially in a private equity-backed timeframe where speed to value is essential.

2. The Partner Equation: What’s the Trade-Off on Margins & Speed?

For many PE-backed companies, partnering with a vendor is the fastest way to solve a problem without slowing down internal teams. But partnerships come with trade-offs:

How much margin or revenue share are you giving up?

Do you lose control over the customer experience?

Does the vendor get stronger by learning from you, eventually becoming a competitor?

“The question is how much you have to give away to forge a successful partnership with a technology provider or ISV. Can you generate an appropriate return relative to the partnership calculation?"

Case Study: Brex vs. Ramp on Travel Management

Brex partnered with Navan (formerly TripActions) to launch travel services immediately.

Ramp built an in-house version, but that meant delaying monetization.

“It’s proof that you can have two different strategies by two very similar companies, and both could work.”

Key takeaway: Partnering gets you to market faster but at the cost of control and margin compression.

3. The Acquisition Test: Can You Justify the Price of Control?

If neither building nor partnering is ideal, the next step is to acquire the capability. But just because an asset is available doesn’t mean buying it is the right move.

Kadaba’s buy-side logic for PE-backed executives:

If the valuation multiple is reasonable, acquiring might be the fastest way to own the revenue and eliminate vendor dependency.

If buying is too expensive, it might be better to partner short-term and build later.

“It’s a function of what the market will bear. Is control worth it relative to partnership, at what price, and can you drive an appropriate return?”

Case Study: Google vs. Amazon on AI Models

Google acquired DeepMind, believing AI was too strategic to outsource.

Amazon partnered with AI vendors, avoiding overpaying in a volatile market.

Key takeaway: Buying eliminates roadmap distraction but only works if the price is right and the asset is truly strategic.

4. The Time-to-Revenue Equation: When Does This Pay Off?

Regardless of cost, the real question every PE-backed executive asks is:

How quickly will this investment generate ROI?

Will it pay off within our investment window?

Is the risk-adjusted return higher than other uses of capital?

Why Time to Revenue Favors Buying in High-Growth Markets

If the market is moving fast, buying or partnering is often the best choice. Why?

Building takes time. If it delays monetization by 12-18 months, it might not be worth it.

Acquiring a company accelerates revenue. The customer base, sales team, and operational playbook are already in place.

📌 Example: Klarna vs. Salesforce

Klarna’s decision to replace Salesforce & Workday with internal systems was a long-term cost savings move, but it delayed immediate operational efficiency.

“They’re looking at this over a 5-10 year horizon. But does that outweigh the immediate lost productivity?”

Key takeaway: If revenue is needed fast, buy or partner. If optimizing for long-term efficiency, building might be worth it.

Final Takeaways for PE-Backed Executives

Kadaba’s Build vs. Buy vs. Partner framework simplifies the decision:

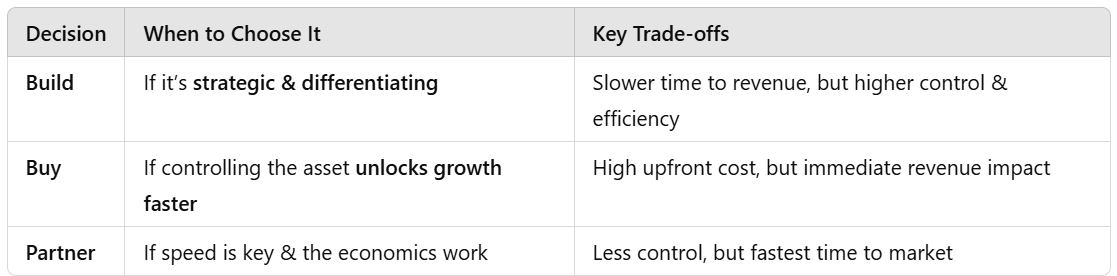

The Decision Matrix for PE-Backed Companies

PE Lens: The Decision is About Maximizing Enterprise Value Within a Defined Timeline

The right move isn’t always the cheapest option—it’s the one that delivers the highest risk-adjusted return within the investment horizon.

If you need EBITDA & revenue impact fast, partner or buy.

If you’re optimizing for long-term efficiency, build.

If control is the differentiator, acquire.

The goal is not just to optimize costs—but to deploy capital in a way that accelerates value creation within the timeline that investors expect.

Apple | Spotify | YouTube

I spoke with Arvind Kadaba, the CFO of Aidoc. We discussed:

Starting his career as a high-profile investor before transitioning into the role of a CFO, and the challenges that come along with that shift

How to choose whether to build, buy, or partner to achieve innovation

Portfolio theory for operators and balancing short-term and long-term investments

How to explain long-term shareholder value to employees

A “contrarian view” that not all businesses should be venture-backed and not all great businesses are tech businesses

This is a masterclass in how PE-backed execs should approach capability gaps, especially in high-cost, operationally critical areas like logistics.

Appreciate the breakdown. It's frameworks like this that help ops leaders move fast without leaving value on the table.